maryland student loan tax credit application 2021

As of the 2022-2023 award year qualified children of undocumented immigrants who are eligible for in-state tuition under 151068of the MD Education Article are also eligible to apply for various state financial aid grants and scholarships. If you paid adoption expenses in 2021 you might qualify for a credit of up to 14440 for each child you adopted.

How To Get A Student Loan Money

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer.

. Explanation for derogatory credit if applicable. Who should complete the Maryland State Financial Aid Application MSFAA. Auto loans of up to 100000 available in 50 states with rates starting at 09.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. Volkswagen Credit Auto Loan is STRONGLY NOT RECOMMENDED based on 40 reviews. Charges a prepayment fee.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Amount paid each month in child care. In order to comply with IRS regulations Towson University will process 1098-T tax forms for tax year 2021 by January 31 2022.

Your loan officer will pull a credit report that shows your accounts but on occasion the information may be outdated missing or erroneous. General knowledge of your current credit card student loan auto loan and other credit accounts. The adoption credit and the adoption benefits exclusion.

For the 2021 tax year if you need a correction to the form you receive or if you do not receive a form but think you are eligible for one contact the TU Bursars Office at 410-704-2100 or email us by March 25 2022. Two tax benefits are available to adoptive parents. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

The credit amount depends on your income.

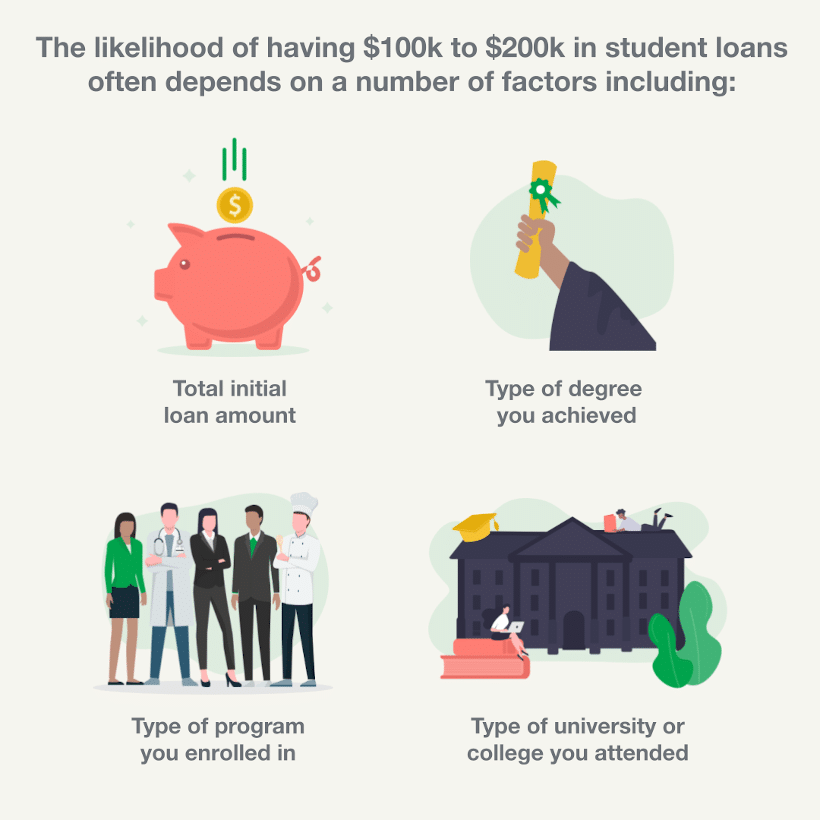

100k In Student Loan Debt Learn How To Pay It Off Purefy

Busting Myths On Student Loan Forgiveness Debate Student Loan Hero

50 Say Mass Student Loan Forgiveness Unfair To Former Borrowers Student Loan Hero

Student Loans Are The Hardest On These Borrowers Npr

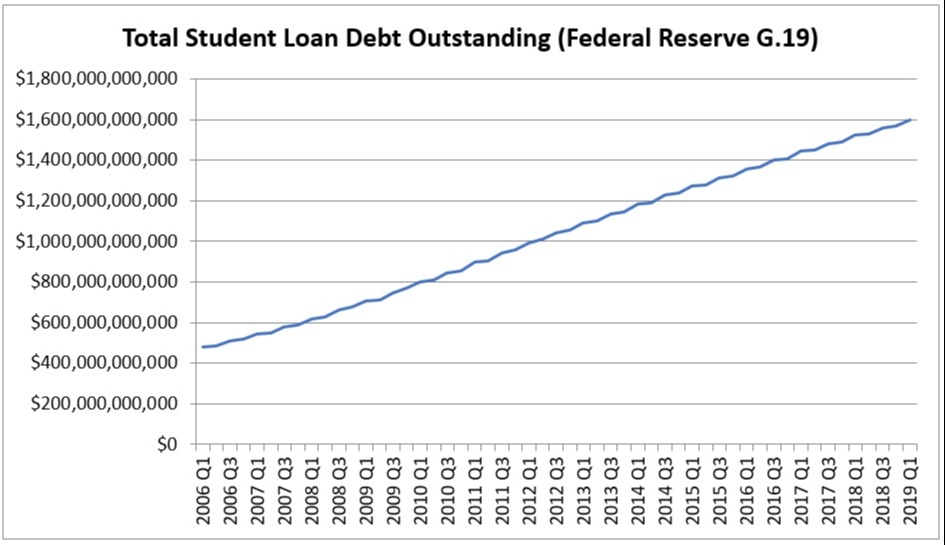

Total Us Student Loan Debt Outstanding Saving For College Blog

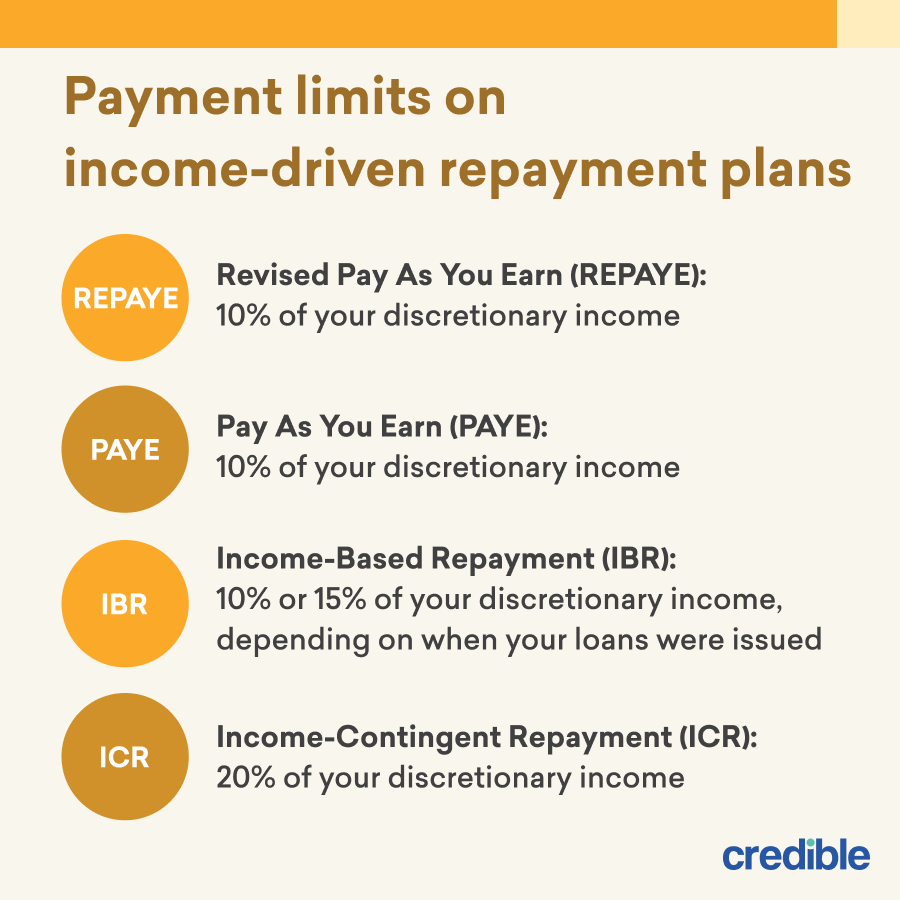

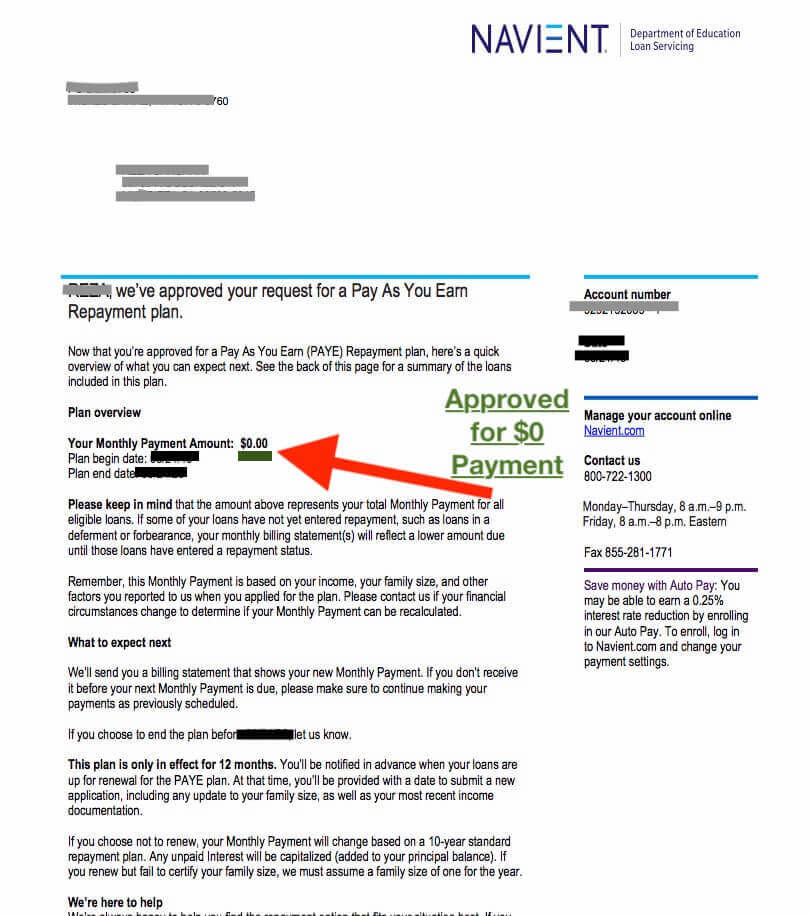

Private Student Loan Forgiveness Alternatives Credible

Learn How The Student Loan Interest Deduction Works

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

6 Best Student Loans Of 2022 Money

Student Loan Forgiveness Statistics 2022 Pslf Data

Banks Turn Cautious On Student Loans In Tamil Nadu The Hindu

Free Student Loan Repayment Tool From Savi

Learn How The Student Loan Interest Deduction Works

100k In Student Loan Debt Learn How To Pay It Off Purefy

Private Student Loan Forgiveness Alternatives Credible

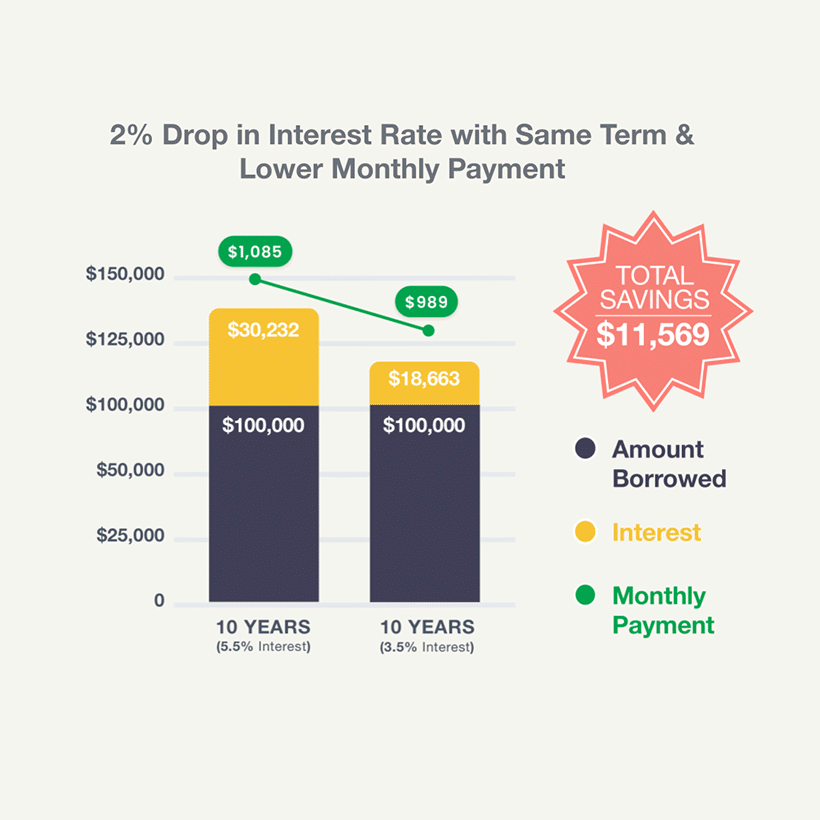

Refinance Medical School Loans Complete Guide The White Coat Investor

Student Loan Forgiveness Help Relief Find Out If You Qualify